kansas dmv sales tax calculator

Vehicle property tax is due annually. First Letter of Last Name.

Income Tax Calculator 2021 2022 Estimate Return Refund

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. DO NOT push any buttons and you will get an information operator. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

Title and Tag Fee is 1050. What you need to know about titling and tagging your vehicle. The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator for 202223.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. If you are unsure call any local car dealership and ask for the tax rate. The sales tax rate varies by County.

Home Motor Vehicle Sales Tax Calculator. The county the vehicle is registered in. When paying in person at the kiosk at either the Olathe or Mission location the credit card convenience fee is 24 of the total transaction amount.

Discover Helpful Information And Resources On Taxes From AARP. When using the Property Tax Check keep in mind that our office will pro-rate your property tax from your. Tax and Tags Calculator.

This includes the rates on the state county city and special levels. The most populous location in Labette County Kansas is Parsons. Average DMV fees in Kansas on a new-car purchase add up to 39 1 which includes the title registration and plate fees shown above.

The introduction of this testing service adds to the Departments expanding online services it provides. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Once you have the tax rate multiply it with the vehicles purchase price. Kansas Vehicle Property Tax Check - Estimates Only. How to Calculate Kansas Sales Tax on a Car.

With KnowTo Drive Online Kansans have the opportunity to. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed California dealer Registration fees for new resident vehicles registered outside the state of California Registration fees for used vehicles that will be purchased in California.

For additional information click on the links below. As far as all cities towns and locations go the place with the highest sales tax rate is Edna and the place with the lowest sales tax rate is Bartlett. Price of Car Sales Tax Rate.

If this rate has been updated locally please contact us and we will update the sales tax rate for Shawnee Kansas. This will be collected in the tag office if the vehicle was. Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc.

New car sales tax OR used car sales tax. Motorized Bicycle 2000. Kansas State Sales Tax.

Whether or not you have a trade-in. Motor vehicle titling and registration. The state in which you live.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. This will start with a recording. Modernization Fee is 400.

The average cumulative sales tax rate between all of them is 881. Sales tax in Shawnee Kansas is currently 96. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator.

Dealership employees are more in tune to tax rates than most government officials. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. The average cumulative sales tax rate in Mcpherson Kansas is 9.

These fees are separate from. Revised guidelines issued October 1 2009. Sales and Use Tax.

Mcpherson is located within McPherson County KansasWithin Mcpherson there is 1 zip code with the most populous zip code being 67460The sales tax rate does not vary based on zip code. The minimum is 65. Kansas Documentation Fees.

Or more 5225. Average Local State Sales Tax. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Sales tax will be collected in the tag office if the vehicle was bought from an individual or purchased out of state. Title fee is 800 tag fees vary according to type of vehicle. In this example multiply 38000 by 065 to get 2470 which makes the total purchase price.

For the property tax use our Kansas Vehicle Property Tax Check. Department of Revenue guidelines are intended to help you become more familiar with Kansas. 2000 x 5 100.

Contact your County Treasurer for an closer estimate of. For your property tax amount refer to County Treasurer. Maximum Possible Sales Tax.

You cannot register renew or title your vehicle s at the Treasurers office located in the. You can do this on your own or use an online tax calculator. Maximum Local Sales Tax.

The type of license plates requested. How Kansas Motor Vehicle Dealers and Leasing Companies Should Charge Sales Tax on Leases. Or less 4225.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. When paying in person at the counter at either the Olathe or Mission location the credit card convenience fee is 26 of the total transaction amount with a 3 minimum subject to change. The most populous zip code in Labette County Kansas is 67357.

Trade In Sales Tax Savings Calculator Find The Best Car Price

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Calculate Sales Tax On Calculator Easy Way Youtube

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Missouri Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

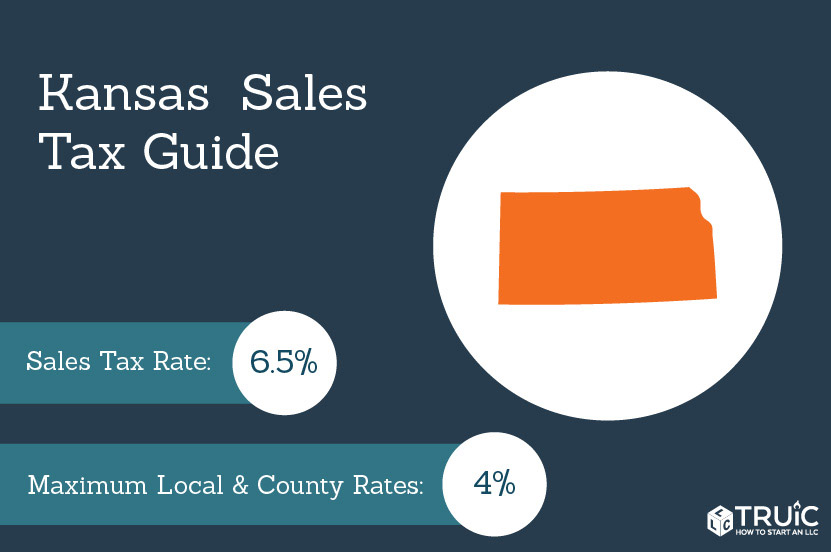

Kansas Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price